WHY YOUR SUPPORT MATTERS

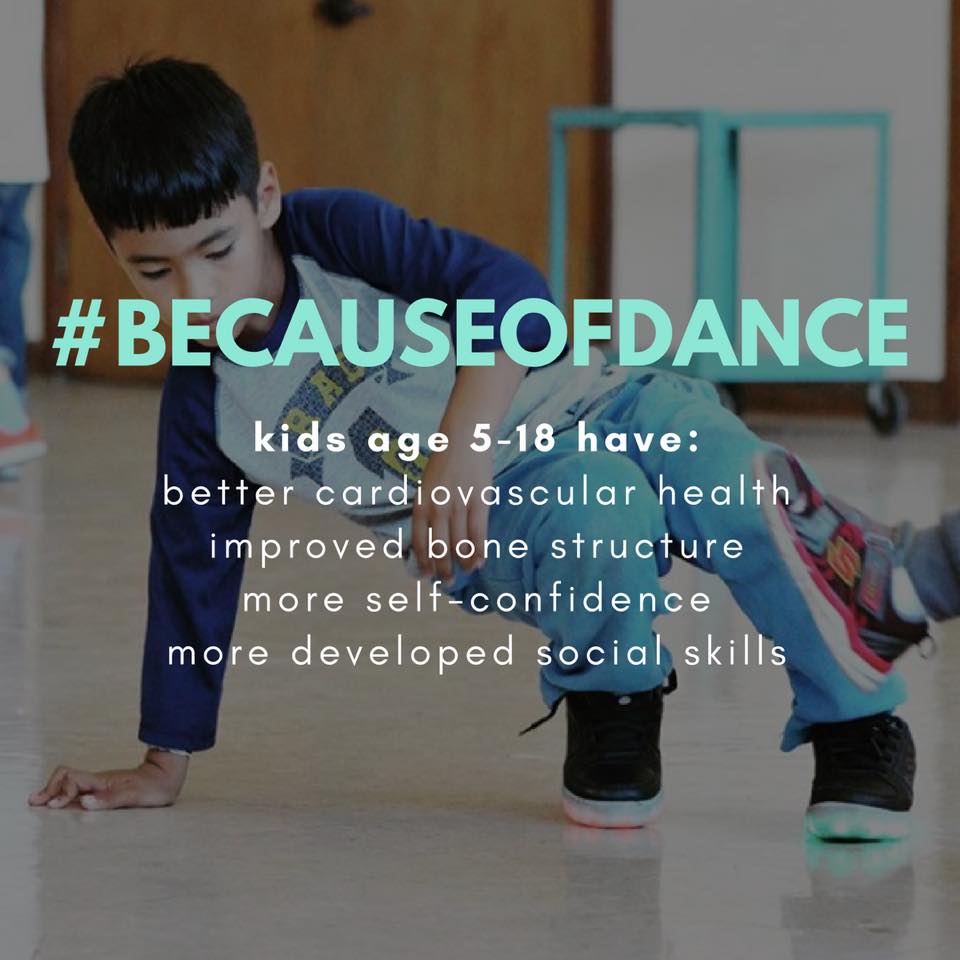

In order to further our mission, ADM accepts tax-deductible contributions from corporations, patrons, supporters, and dance fans, and raises additional funds to support the work of the foundation. Every $62 donation funds one student’s dance education for one year. Your support will help us achieve our goal and allow more students the beautiful gift of dance.

There are several ways that you can make a donation:

DONATE ONLINE

SHOP WITH AMAZONSMILE

You can increase American Dance Movement’s donation potential as you shop by using AmazonSmile. The AmazonSmile Foundation donates 0.5% of the purchase price of eligible AmazonSmile items to charities and there’s no cap on how much they will donate!

By clicking on our charity specific link below you will be taken directly to our foundation page, making it easy for you to select and support American Dance Movement as you shop.

MATCHING GIFTS

Your gift to the American Dance Movement could be matched dollar for dollar by your employer! Many employers across the United States sponsor matching gift programs and will match any charitable contributions or volunteer hours made by their employees to non-profit organizations like American Dance Movement. To find out if your company has a matching gift program, contact your human resources department.

CONTACT US

For further information on ways to donate to American Dance Movement, or to follow up on a donation already made, please be sure to email us at donations@americandancemovement.org

Mailing Address: 578 Washington Blvd. #1500, Marina del Rey, CA 90292

American Dance Movement is a tax-exempt nonprofit organization, qualified under section 501(c)3 of the Internal Revenue Code.

All contributions are tax-deductible. Federal Tax Identification No: 26-4501295